A comparative study of export statistics up to the end of April calls for a degree of caution when making judgements or interpretations. The impact of the transport strike in Spain, which lasted almost 15 consecutive days in March 2022, and its subsequent effect on delays to cargoes originally accumulated, means that the figures may be distorted if they are compared without taking this factor into account.

2 – OVERALL ANALYSIS

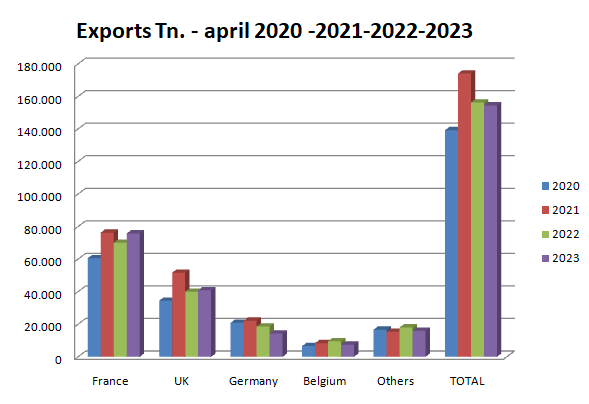

Overall, there was a -1.10% fall in the volume exported during the first 4 months of the year (Tonnes 2022: 156,264 vs. Tonnes 2023: 154,546). These figures alone seem to reflect a slowdown in the markets, but it is impossible to verify whether this percentage is real, as we do not know the volume of slate immobilised during the strike and the following weeks, nor the time required to transport it to the various markets.

The statistics for May and June will enable us to get closer to the figures and draw more realistic conclusions.

2 – ANALYSIS BY COUNTRY

France

We are seeing significant growth compared to 2022 (+8.22%), which is no doubt linked to the negative effects of the transport strike. If we compare the figures for 2023 with the rest of the previous years since 2019 (with the exception of 2020, which was affected by an interruption in production during the pandemic), we can see that the French market is maintaining a fairly regular import curve with a high volume of tonnes (2019: 73,843 Tn. – 2021: 76,336 Tn. – 2022: 70,083 Tn.): demand tension in this market remains high, and the reductions seen in the construction of new houses in France are not having a major impact on slate because of its strong presence in the renovation market. In other Newletters, we have mentioned the slowdown in quarry production over the past few years, and we are sure that this is having a particular impact on France, which is the world’s biggest demand for slate.

United Kingdom

This market has felt the effects of the March 2022 strike the most, due to its lack of flexibility in transport, as it has to combine land and sea transport, which means that goods from quarries have taken longer to be positioned on the market. We therefore stress the importance of knowing the data for May and June for a more realistic interpretation.

Belgium

Belgium is gradually returning to the purchasing levels of previous years, at around 7,000 tonnes over the first 4 months of the year. The fall in 2023 is considerable (-21%) compared with 2022, but it should be noted that this figure corresponded to record import levels.

CONCLUSION

Demand has been so intense since the pandemic that, at present, the slightest sign of weakness in one country casts doubt on the behaviour of the markets in the medium term; whereas, in reality, it is certain that it will be very difficult for the slate sector to return to the production levels of recent years because of production costs, the lack of manpower despite mechanisation, the age of certain quarries and the closure of a good number of them. The gap between global demand for slate and actual production capacity is still wide, and although the economic situation is slowing down the construction sector, no particular tension between supply and demand for our product is expected.

We are awaiting export figures for May and June so that we can analyse market and production behaviour in more detail.

Source: Clúster da Pizarra de Galicia.