The year 2024 ended with exports down by 5.74% overall. Worldwide slate sales were affected by the general economic slowdown, and even more so by high interest rates, which heavily penalised new construction. For natural slate, the renovation of old roofs fortunately continued at a good pace, despite the backlog accumulated in recent months due to unfavourable weather conditions. The fall in sales was therefore less pronounced than for other roofing materials.

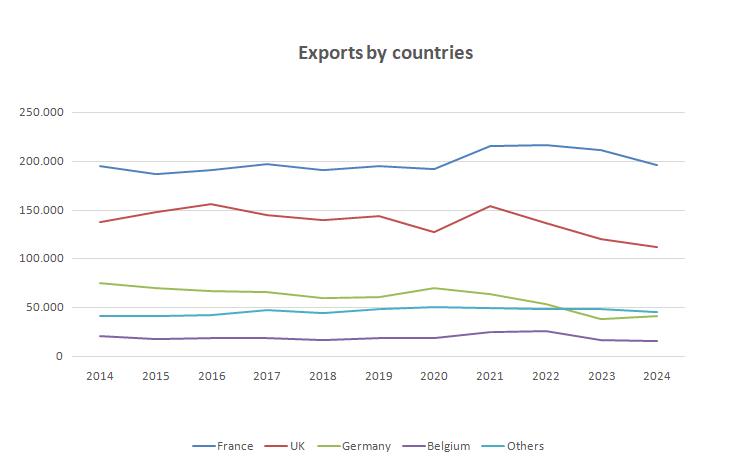

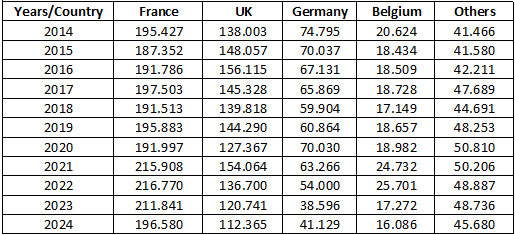

Analysis by country

France

The French market continues to be the leading market for Spanish slate abroad. The tonnage exported amounts to 196,580 tonnes, down 7.20% on 2023. After several years of growth, this negative figure should be put into perspective. It comes from a comparison with a post-pandemic period in which demand rose disproportionately and uncontrollably, while far exceeding production capacity. We are therefore now faced with more moderate export figures and a market that is gradually approaching the pre-pandemic situation, which seems to us to be more logical and more in line with production capacity and market realities. In France, renovation activity has remained at very acceptable levels, although the weather conditions in the latter part of the year caused considerable delays that are difficult to make up.

The UK

Once again this year, the UK continues to be the second largest export market for slate, with a fall of 6.94%. Sales of slate to this market are mainly for new buildings. As in other countries, this is the sector most affected by the economic slowdown and consumer uncertainties, compounded by high interest rates and the effect of inflation in the property sector.

Germany

The days when Germany was the second largest importer of Spanish slates are long gone. The crisis concentrated in the property sector and the uncertainty of figures that sometimes border on recession are having a direct effect on sales. The year 2024 shows a 6.56% increase in the volume of imports, reaching 41,129 Tn. On the face of it, this could be a positive figure, but it is attenuated if we compare it with the more than 100,000 Tn that Germany accounted for in another, not so distant, era.

Belgium

Alongside the rest of the world, where the Spanish slate is very traditional, Belgium will see a fall of 6.87% in 2024. The situation that justifies these figures is also similar to the rest of the markets.

Source : Clúster de Pizarra de Galicia